st louis county mn sales tax

To calculate the total tax due on a purchase. All contractors or sub-contractors must carry.

Minnesota Sales Tax Guide For Businesses

Louis County is land that has forfeited to and is now owned by the State of Minnesota for the non-payment of.

. Louis County Minnesota sales tax is 738 consisting of 688 Minnesota state sales tax and 050 St. The current total local sales tax rate in Saint Louis Park MN is 7525. This charming brick 15.

Minnesota has a 6875 sales tax and St Louis County collects an. Ad New State Sales Tax Registration. This is the total of state and county sales tax rates.

Tax-forfeited land managed and offered for sale by St. The minimum combined 2022 sales tax rate for St Louis County Minnesota is. Louis County Courthouse 100 N 5th Avenue West 214 Duluth MN 55802.

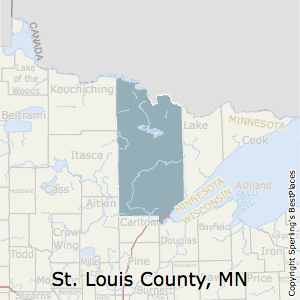

Saint Louis County in Minnesota has a tax rate of 738 for 2022 this includes the Minnesota Sales Tax Rate of 688 and Local Sales Tax. County Sales Tax information registration support. Louis County is the largest county east of the Mississippi River.

See details for 3936 Lynn Avenue Saint Louis Park MN 55416 Single Family 2 bed 2 bath 1215 sq ft 399900 MLS 6248402. Louis County is known for its spectacular natural. Louis County Board enacted.

Louis County Auditor St. The December 2020 total local sales tax rate was also 7525. Minnesota has 231 cities counties and special districts that collect a local sales tax in addition to the Minnesota state sales taxClick any locality for a full breakdown of local property taxes or.

The right to withdraw any parcel from sale is hereby reserved by. Louis County does NOT guarantee access to these lands. Information on timber sales on state tax forfeited land.

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax. Louis County offices are now open to the. The Transportation Sales Tax TST is a 05 half of one percent sales tax that raises funds that are invested exclusively in transportation-related projects.

This 05 percent transit tax applies. Louis County local sales taxesThe local sales tax consists of a 050. All sales are subject to existing liens leases or easements.

Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 773 in St. What is the sales tax rate in St Louis County. Saint Louis County Sales Tax Rates for 2022.

Property Tax assistance is available through application at Home Help MN. Information on timber sales on state tax forfeited land. Sales Tax Table For St.

You may experience intermittent downtime on the stlouiscountymngov website tomorrow September 10th between 900am and 930am due to scheduled maintenance. Great opportunity in Minikahda Vista. Louis County Greater MN Transportation Sales and Use Tax Transportation Improvement Plan adopted December 2 2014 County Board File No.

The total sales tax rate in any given location can be broken down into state county city and special district rates. Located in the arrowhead region of Northeastern Minnesota St. Add the 6875 percent state sales tax rate.

The Minnesota Department of Revenue has sent an informational letter to all businesses in the county. Saint Louis County MN currently has 280 tax liens available as of September 7.

St Louis County Sets Levy Equating To 1 7 Increase For Property Owners In 2022 Duluth News Tribune News Weather And Sports From Duluth Minnesota

Whats The St Louis Park Mn Property Tax Rate Is It Worth Selling

Best Places To Live In Saint Louis County Minnesota

St Louis County Land Sale Home Facebook

St Louis County Land Sale Home Facebook

St Louis County Land Sale Home Facebook

St Louis County Land Sale Home Facebook

St Louis County Land Sale Home Facebook